EPF dividend 2019: 5.45 pct for conventional, 5 pct for syariah

The Employees Provident Fund (EPF) today declared a dividend of 5.45 percent for conventional savings and five percent for Syariah savings in 2019.

The conventional saving dividend amounted to RM41.68 billion while the dividend for Syariah savings, which was introduced in August 2016, amounted to RM4.14 billion.

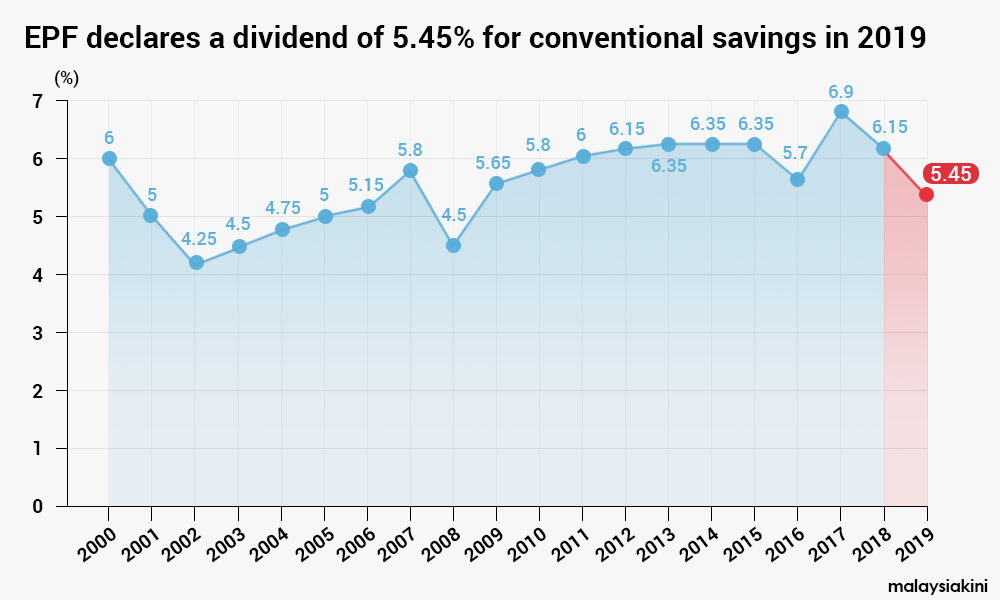

The conventional dividend rate of 5.45 percent is the lowest since 2008, when a dividend of 4.5 percent was announced. The conventional and Syariah dividends for 2018 were 6.15 percent and 5.9 percent respectively.

However, the EPF in a statement said the dividend of 5.45 percent is a "solid performance" amid a challenging 2019.

It added that the declared dividend was 2.95 percent higher than its mandate under the EPF Act 1991 which requires the fund to deliver a nominal dividend of at least 2.5 percent every year.

"As anticipated, we saw substantially more volatility in 2019 as compared to 2018. Certainly, 2019 exemplified what it means to be living in a VUCA (volatility, uncertainty, complexity and ambiguity) world.

"Many issues in the global markets remained unresolved, but we also saw some new issues cropping up. There were three rate cuts made by the US Federal Reserve, the US-China trade spat escalated and continues to be unresolved, and uncertainties were surrounding the Brexit negotiations," said EPF chief executive officer Alizakri Alias.

"On top of this, we did not expect the Hong Kong protests to be prolonged and that certainly added pressure on an already fragile far-east market.

“Also, the domestic markets did not support the income-generating capabilities of the EPF as 70 percent of the fund’s assets are in Malaysia, with a major part of our assets in domestic equities," he added.

Alizakri said EPF's strategic asset allocation and decision-making structure provided a robust system that guided and shielded the fund from the economic storms.

Alizakri also explained that the lower Syariah dividend was due to there being less Syariah-compliant assets to invest in compared to conventional ones.

"The dividends from Simpanan Syariah differs because the universe of assets that we can invest in and which is Syariah-compliant is not as wide as that available for the conventional option. A majority of the investments were in the domestic markets, which did not perform as well in 2019," he said.

Alizakri said the EPF expects this year to be more challenging.

“We expect that 2020 is going to be just as or even more challenging than 2019, with the full impact of the Covid-19 virus likely to drag down already soft global growth," he said.

"The US-China trade war still sees no signs of ending, among other risks to economic recovery.

"We hope that the domestic markets will be resilient, especially in light of the soon-to-be-announced government stimulus package which should help support investor and consumer sentiment."

RM12.50 / month

- Unlimited access to award-winning journalism

- Comment and share your opinions on all our articles

- Gift interesting stories to your friends

- Tax deductable