PAYLATER App Review Article Contest - Wallace Kew

The Covid-19 pandemic has placed many businessmen and citizens in a detrimental financial position where the insolvency rate of SMEs and employment dismissal rate increased drastically. Nevertheless, this pandemic has created an opportunity for the PAYLATER App to be on an upward trajectory to assist the citizens and businesses to survive the pandemic after having regard to the relatively “high and adequate” spending limit conferred by PAYLATER.

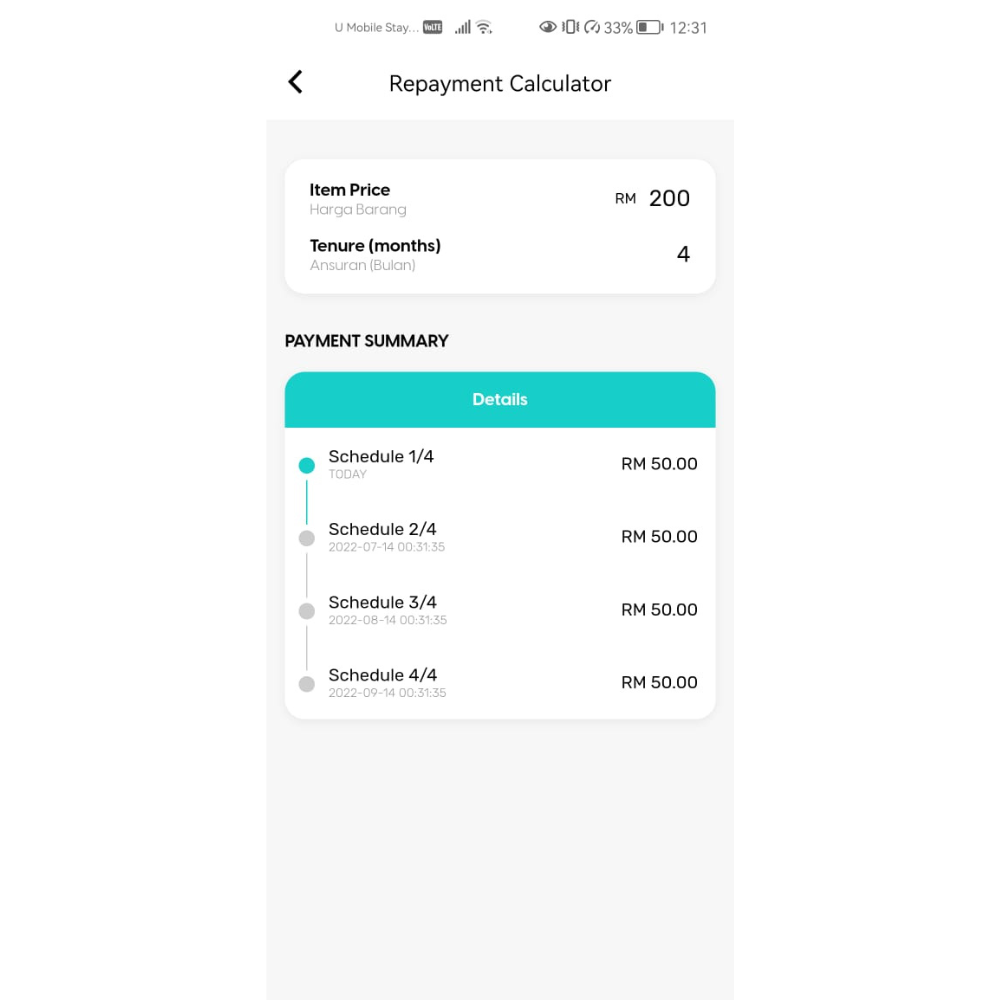

Furthermore, instead of paying a lump sum for purchases, the users may split the payments into smaller installments over 4 months or even longer, thereby easing the customer’s cash flow burden.

Moreover, the approval process to kick off the PAYLATER App can be completed with just a mere debit card and the process is way faster and more efficient than applying for a bank’s loan or credit card. The author believes that such convenience could encourage more users to sign up for the apps.

Essentially, the author opines that PAYLATER acts as a supportive financial intermediary boosting the nation’s economy and further encouraging the nation’s economic recovery while accelerating the transition to a healthier economy. This is achievable through supporting affordable housing expenses and strengthening the financial well-being of businesses.

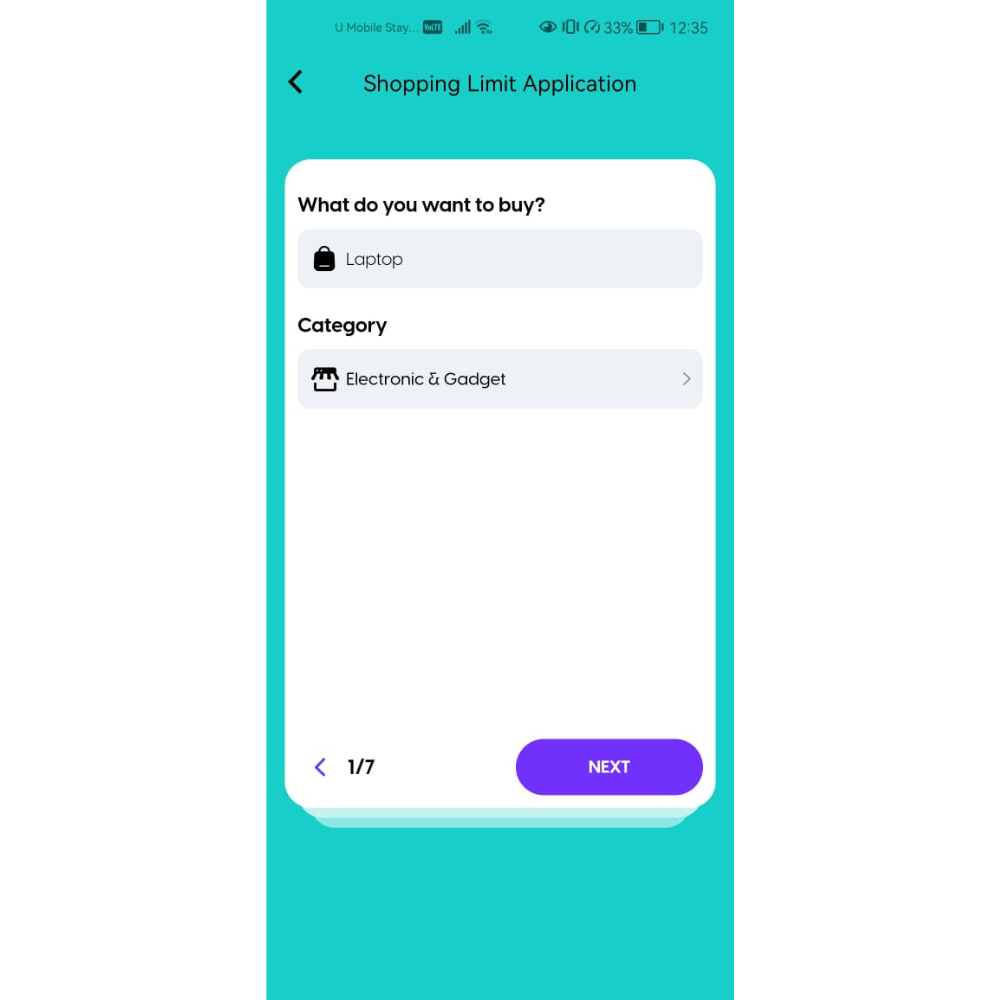

One of the Unique Selling Points (USPs) and special features of PAYLATER App is the credit limit imposed by PAYLATER is based on the user’s assessment. Theoretically, there is no maximum cap on the shopping limit provided that the user’s application for a higher shopping limit is approved subject to T&Cs being complied with. On the contrary, other BNPL players generally impose credit limits ranging from RM1,000 to RM 10,000 such as Atome, myIOU, SPayLater etc.

Furthermore, the repayment tenure is more flexible and considerate. Although the default tenure is 4 months, nevertheless, the repayment tenures may be extended up to 24 months upon the user’s request. Moreover, should the users opt for default repayment tenure, it will be completely interest-free. This factor would benefit many shoppers especially current banks’ loan policies which impose a higher interest rate ranging from 3.5% - 9.8% p.a. or even higher.

On top of that, customers are able to shop from over 600 of the top brands through the PAYLATER App, which consist of most of the popular electronic & gadgets brands including Apple, Samsung, Huawei, Vivo, Xiaomi, DJI and more. Besides that, they also provide home and living, fashion brands, cosmetic products and the list goes on!

There are no processing fee or hidden charges incurred for PAYLATER, unlike SPayLater that charges 1.25% a month on the total order amount if the user opts for an installment plan.

If there is a late payment, PAYLATER App merely charges a comparatively lower penalty of RM10 for every 7 days of non-payment. Conversely, other BNPL apps such as Atome, Grab’s PAYLATER charge higher late payment penalties as well as account reactivation fees ranging from RM30 to RM75.

Besides, the age requirement to download the PAYLATER App is 18 years old which is lower as compared to Grab’s PayLater which imposes a higher age requirement of 21 years old, thereby largely restricting its customer base.

In relation to positive comparison and review, the prerequisite to commence the use of PAYLATER App is more convenient as compared to the typical credit card application that involves lengthy assessment periods where submission of pay slips, bank statements, and employment information are mandatory. In contrast, PAYLATER App merely requires regular sign-up details like the applicant’s name, phone number, NRIC number, and debit/credit card details.

After using the application, the author advises PAYLATER to increase the number of merchant partners because the current merchant partners are relatively fewer compared to other BNPL apps. This is achievable by incorporating certain luxury brands like Coach, Louis Vuitton, Hermes and others.

Although it is applaudable that PAYLATER offers an instant rebate of RM25 for new users, even so, the author suggests that PAYLATER increases the numbers of vouchers or promo codes to be made available for its users because other industry players offer more vouchers with a lower amount of minimum spend.

All in all, let’s give PAYLATER a whirl to better understand and experience the extensively developed PAYLATER App.

Find more information:

PAYLATER official website: https://www.paylater.com.my/

Register as a PAYLATER user: https://bit.ly/3sg3qm8

RM12.50 / month

- Unlimited access to award-winning journalism

- Comment and share your opinions on all our articles

- Gift interesting stories to your friends

- Tax deductable