4th Malaysia Tax Policy Forum Hosted by Cheah Chyuan Yong and Keynote from YB Lim Hui Ying, Deputy Finance Minister

The 4th Malaysia Tax Policy Forum (MTPF), organised by the International Strategy Institute (ISI), successfully concluded on June 11, 2024. The event at the Everly Hotel, Putrajaya, brought together over 200 participants, including policymakers, tax professionals, and industry leaders.

Image above: From left to right -Tan Sri Zamrose Mohd Zain, Honorary Advisor of ISI; Cheah Chyuan Yong, Chairman of ISI; YB Lim Hui Ying, Deputy Finance Minister; Dato Seri Dr Mohd Nizom, Organising Chairman; Dato' Sri Shamsun Baharin bin Mohd Jamil, Director General of National Anti-Financial Crime Centre.

The forum was graced by YB Puan Lim Hui Ying, Deputy Minister of Finance, who delivered an insightful keynote address highlighting the government's commitment to ensuring a fair and efficient tax system. During her speech, she mentioned that "tax revenues are essential for supporting public services, infrastructure development, and social programs, which are fundamental to our nation's prosperity."

After three successful Malaysia Tax Policy Forums, Mr Cheah Chyuan Yong, Chairman of the International Strategy Institute (ISI), continued his legacy with the 4th one with this year's organising chairman, Dato Seri Dr Mohd Nizom. ISI's mission to promote informed dialogue and innovative solutions on key policy issues will be ongoing.

YBhg Datuk Dr. Abu Tariq Bin Jamaluddin, CEO/Director General of the Inland Revenue Board Malaysia (LHDN), delivered a special luncheon address. He shared his vision of modernising tax administration and fostering greater compliance through technological advancements.

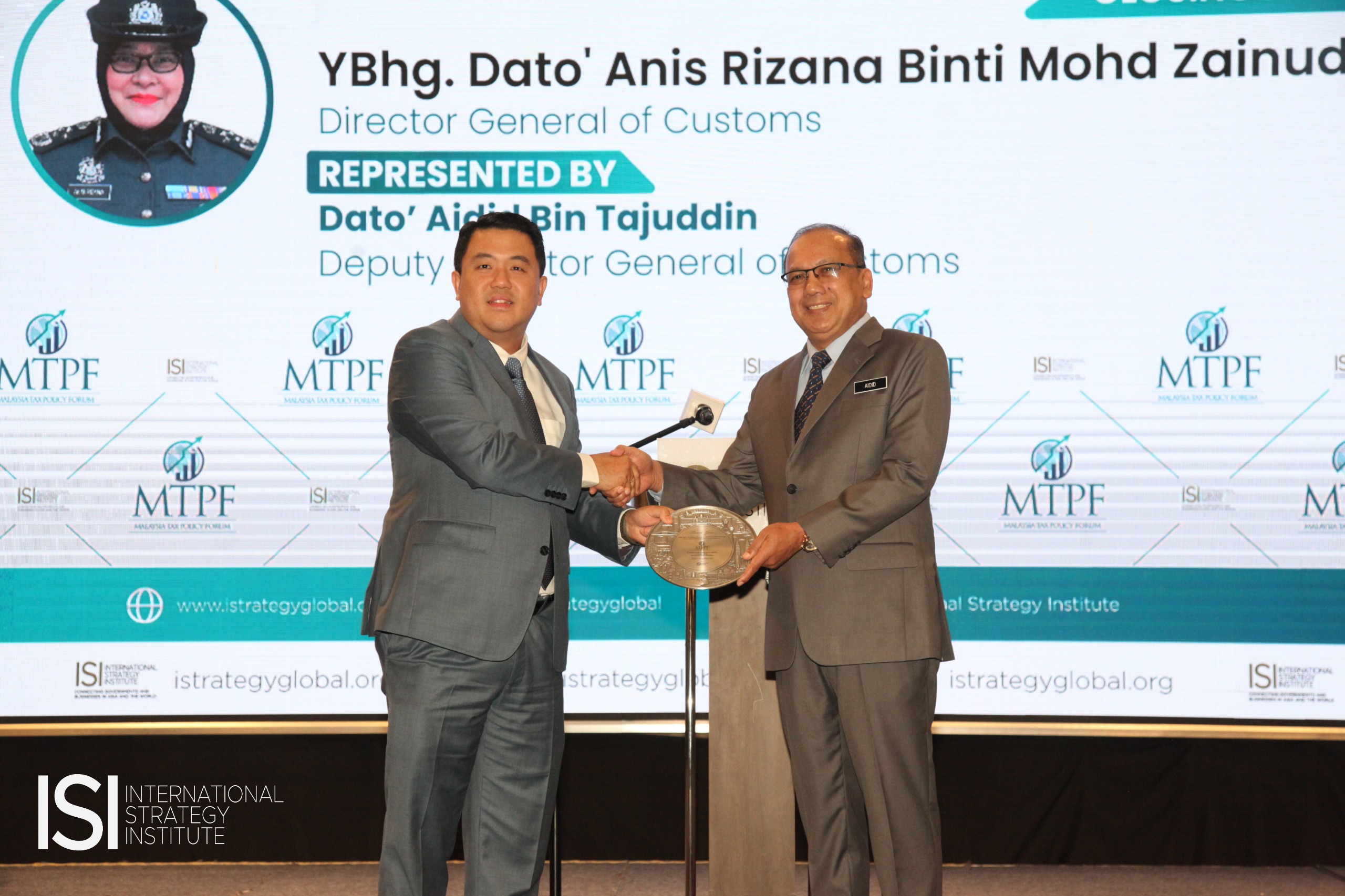

Dato' Aidid Bin Tajuddin, Deputy Director General of Customs, delivered the forum's closing remarks, representing Dato' Anis Rizana binti Mohd Zainudin, Director General of Customs. He emphasised the need for continued cooperation and innovation in tax policy to support Malaysia's economic growth.

Throughout the day, attendees engaged in dynamic discussions on various topics, including tax reforms, digital taxation, and international tax cooperation. Expert panels and interactive sessions facilitated the exchange of ideas and best practices, fostering a deeper understanding of the evolving tax landscape.

One of the forum's highlights was the presentation of new research findings on tax compliance and the impact of digitalisation on tax administration. These findings are expected to inform future policy decisions and enhance the effectiveness of Malaysia's tax system.

ISI extends its gratitude to all speakers, sponsors, and participants for their valuable contributions to the forum's success.

This content is provided by IAF Strategy Sdn Bhd.

The views expressed here are those of the author/contributor and do not necessarily represent the views of Malaysiakini.

Interested in having your announcements on Malaysiakini? Contact the announcements team at [email protected] or WhatsApp on +60 17-323 0707 for urgent matters.

RM12.50 / month

- Unlimited access to award-winning journalism

- Comment and share your opinions on all our articles

- Gift interesting stories to your friends

- Tax deductable