HariGaji, solving the crunch between paydays with earned wage access

Just RM 150 would have helped him repair his bike for work, just RM 90 would have helped her buy groceries for her family and just RM 40 would have helped them take their children to a doctor’s appointment. The problem is some people just do not have these amounts of money in their bank account when they need it. As a result, they tend to resort to unethical means of borrowing to meet these financial emergencies. HariGaji was created to solve this problem, by acting as a one-stop financial wellness platform that hopes to improve financial literacy and flexibility by offering earned wage access amongst other services.

Having worked as an engineer, co-founder, Annamalai noticed that construction workers struggle to meet financial emergencies towards the end of every month, essentially living paycheck to paycheck. This was very apparent as they would regularly try to borrow from senior colleagues to cover their day-to-day expenses. This was abundantly clear from the Malaysian statistics; 89% of Malaysian urban poor youth pay bills late due to limited cash and 73% of the urban poor youth worry they will be delaying their monthly bills. With the use of HariGaji, these individuals can essentially use up some of the money they had earned during the month when they most need it, instead of waiting until the end of the month.

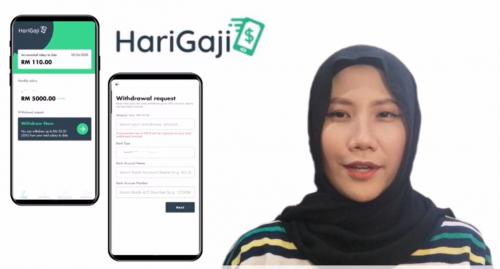

To accomplish such a service, it was necessary for HariGaji to develop a strong technological solution that will fit in with the current payroll ecosystem in Malaysia. HariGaji’s commitment to this has seen the development of API documentation for integration, together with its own iOS and Android applications. These applications have been developed with the end-user in mind, ensuring that it is easy to use and can support multiple languages.

HariGaji was formed in 2020 by a young local sibling duo, who were determined to make it in the fast-growing startup community in Malaysia. Becoming technology entrepreneurs during a pandemic was no easy task and came with its challenges. Furthermore, the concept of earned wage access was very new to the ASEAN region, with only a handful of other providers to this day. With an eagerness to succeed Annamalai and Ambika continued to persevere through the tough times with the help of several accelerator programs and social media marketing as they began to understand the workings of the startup environment. They were also pleasantly surprised by the supportive nature of the Malaysian startup ecosystem, as they came across many VCs, grants and support networks that were open to having conversations. One major milestone for HariGaji in 2020 was being awarded the MAGIC-SIM grant which provided them with some additional funding to develop their product further to meet their end goal of improving the financial literacy of Malaysians.

Soon after, HariGaji was crowned champion in the VynnHack 2021 competition and was accepted into the MAGIC GAP programme cohort 5. These successes came at the right time just as HariGaji started to find its footing and stabilising its operations with over 20 enterprises onboarded onto the platform. Determined to raise some capital and grow the startup, HariGaji committed to the GAP programme and is looking forward to the Final Demo Day that is fast approaching. MaGIC’s GAP programme has been instrumental in preparing HariGaji for their fundraising round as it offered a series of lectures covering key elements of running a startup together with access to a comprehensive range of mentors to help them.

This content is provided by Malaysian Global Innovation & Creativity Centre (MaGIC).

Interested in having your announcements on Malaysiakini? Contact the announcements team at [email protected] or whatsapp on +60 17-323 0707 for urgent matters.

RM12.50 / month

- Unlimited access to award-winning journalism

- Comment and share your opinions on all our articles

- Gift interesting stories to your friends

- Tax deductable