Malaysian businesses geared up for recovery

For more than a decade, Grant Thornton’s International Business Report (IBR) data has tracked the health and outlook of the global mid-market. Launched in 1992, the research provides insight into the views and expectations of more than 10,000 businesses across 30 economies. Now, its latest research, conducted in May and June 2020, reveals just how far the economic shock of the COVID-19 pandemic has impacted mid-market businesses.

The COVID-19 pandemic, subsequent lockdown and resulting economic shock have tested businesses in Malaysia in an entirely unprecedented ways, and their impact is likely to be felt for years to come. But, against this backdrop, IBR data finds Malaysian businesses to be relatively upbeat.

In Malaysia, although 70% of mid-market businesses said COVID-19 would hit their 2020 revenues, the data suggests the impacts on the mid-market fall short of the worst predictions of the wider economy. By comparison – and in findings that are common across other sentiment surveys of all sizes of firm – CNBC’s Global Q2 CFO Council Survey reported that 88% of CFOs expect a “negative” or “very negative” impact to their businesses.

36% of businesses anticipate a decline of less than 20% revenues, while 34% expect a greater than 20% fall in revenues.

In the global spectrum, over 65% of businesses around the world expect COVID-19 to have a negative impact on revenues in 2020. Most firms (around 40%) anticipate a decline of less than 20% in revenues, while 1-in-4 expect a greater than 20% fall in revenues.

While the pandemic’s impact has been significant, only 1% of IBR respondents in Malaysia said they expect to cease trading as a result of it. 86% of businesses expect to continue trading based on their existing financial situation, while 56% said they can continue to trade using existing funds but would need to cut costs and/or restructure. 8% said they would need to supplement cost-cutting and restructuring with access to new funding from lenders, investors or government grants.

“Businesses in Malaysia have shown signs of resilience despite the negative impact of the pandemic. They are agile and have taken active steps during lockdown particularly in adjusting their business strategy and managing their cashflow,” said Dato’ N.K. Jasani, Country Managing Partner of Grant Thornton Malaysia PLT.

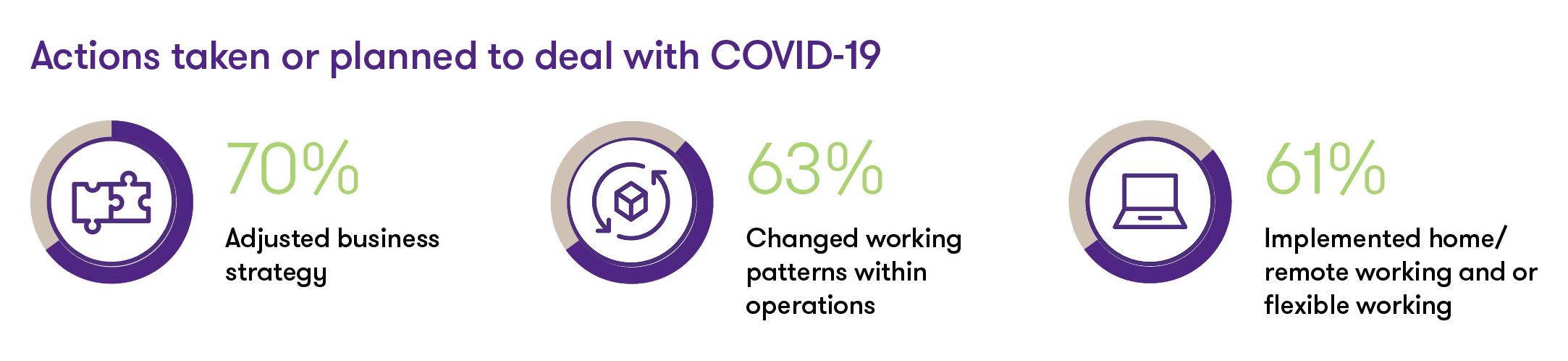

The IBR data found 70% of businesses had made significant and fundamental changes by adjusting their business strategy to meet the transformative nature of the new trading environment. 63% of businesses have changed working patterns within operations. Given the nature of the pandemic, it’s little surprise that slightly over 60% of businesses implemented flexible working arrangements. Generally, companies were more likely to change strategy in sectors where significant revenue losses were expected.

Cash-flow management is the most critical issue for businesses experiencing significant stress or distress. To ensure liquidity, half of the businesses negotiated with customers to get them to pay early and close to half of the businesses asked for discounts on supplies. 45% of businesses swept idle cash into working capital or drew down on banking facilities.

In terms of seeking for funds, slightly over 30% of businesses sought for government grants and have spoken to lenders about new credit. 37% of businesses sought financial support from investors.

To stop further losses, 37% of businesses acted to this pandemic by reducing or suspending operations and 33% of businesses reduced labour costs through cutting pay, staff or both.

Pre-empt the risks in a recovery

Since Conditional Movement Control Order (CMCO) where various industries were allowed to reopen, businesses have started future preparations. 77% of businesses are already considering workplace safety in preparation for the recovery in their markets. As lockdown recovery restrictions continue to be eased during the Recovery Movement Control Order (RMCO) phase, when people return to work will be critical to preventing a second wave outbreak and a large majority of firms are already considering how to manage this process.

The transition out of a crisis is often the most vulnerable period for an organisation. Ramping up purchasing orders and building inventories can quickly overstretch businesses and drain liquidity as they spend more to get back on to a ‘normal’ or growth footing.

As such, cash flow will remain a critical concern for many companies as they enter the recovery phase. 57% of businesses said they have started planning for financial resources to help them through recovery.

Businesses are also thinking hard about how they focus their resources to ensure stable and profitable recovery through a turbulent economy. Around 60% said they have started identifying which customers and markets to prioritise as well as which products and services will best sustain them.

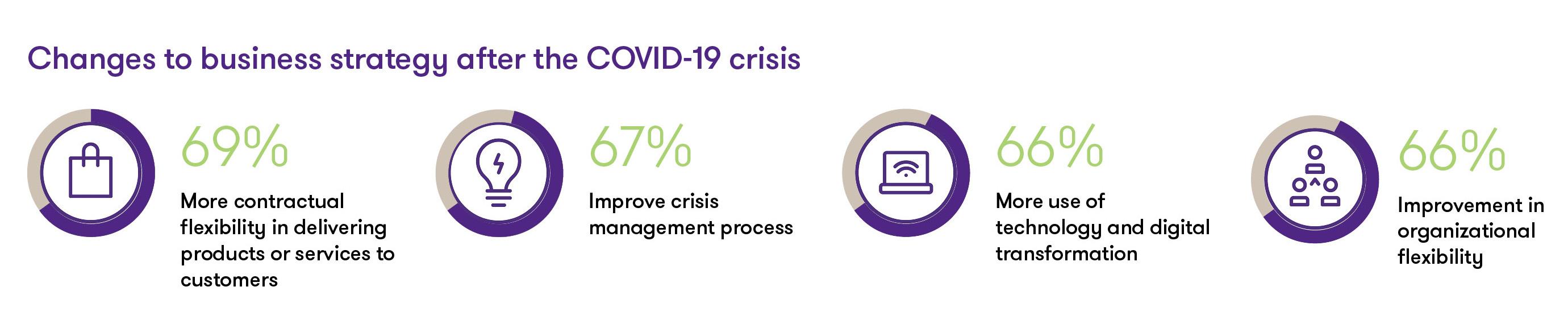

“Moving forward, it is crucial for businesses to change their business strategy to adapt to the post COVID-19 conditions. Future changes around crisis management, the use of technology, and improved organisational flexibility are highlighted as key to future business strategy development,” added Dato N.K. Jasani.

Learning from the difficulties faced during the lockdown, 69% of businesses are planning to offer more contractual flexibility in delivering products or services to customers.

Besides that, 67% businesses plan to improve their crisis management process. As the lockdown forced businesses to limit or halt physical operation, businesses need to constantly evolve their response to meet the ongoing dynamic situation.

In addition to identifying a need to use more technology and digital transformation in business strategy going forward, the COVID-19 crisis has highlighted a need for better organisations flexibility in terms of when, where and how the work gets done. (recognised by 66% of Malaysian businesses respectively).

“The Malaysian Government played the leading and crucial role in the recovery of our economy in terms of introducing several stimulus packages to benefit the businesses and the people.

Dato’ Jasani added that, “The stimulus packages were well-received where business owners opined that the discount of 2% and 15% on electricity bills for tourism, commercial, industrial, agricultural sectors where helpful (63%), followed by the Wage Subsidy Program (60%) and the financing facilities assistance which includes the moratorium (57%).”

“The Malaysian Government, particularly under its umbrella the Ministry of Finance, Social Security Organisation (SOCSO), Bank Negara, Credit Guarantee Corp, Malaysia Digital Economy Corporation (MDEC), as well as the Ministry of Human Resources are to be commended for the substantial help to all the Malaysian businesses,” concluded Dato’ N.K. Jasani.

RM12.50 / month

- Unlimited access to award-winning journalism

- Comment and share your opinions on all our articles

- Gift interesting stories to your friends

- Tax deductable