Prudential Malaysia commits more than RM2 million for Covid-19 Coverage

Prudential Assurance Malaysia Berhad (PAMB) and Prudential BSN Takaful Berhad (PruBSN) today announced more than RM2 million in commitment to provide Covid-19 insurance and takaful protection to customers as well as non-customers.

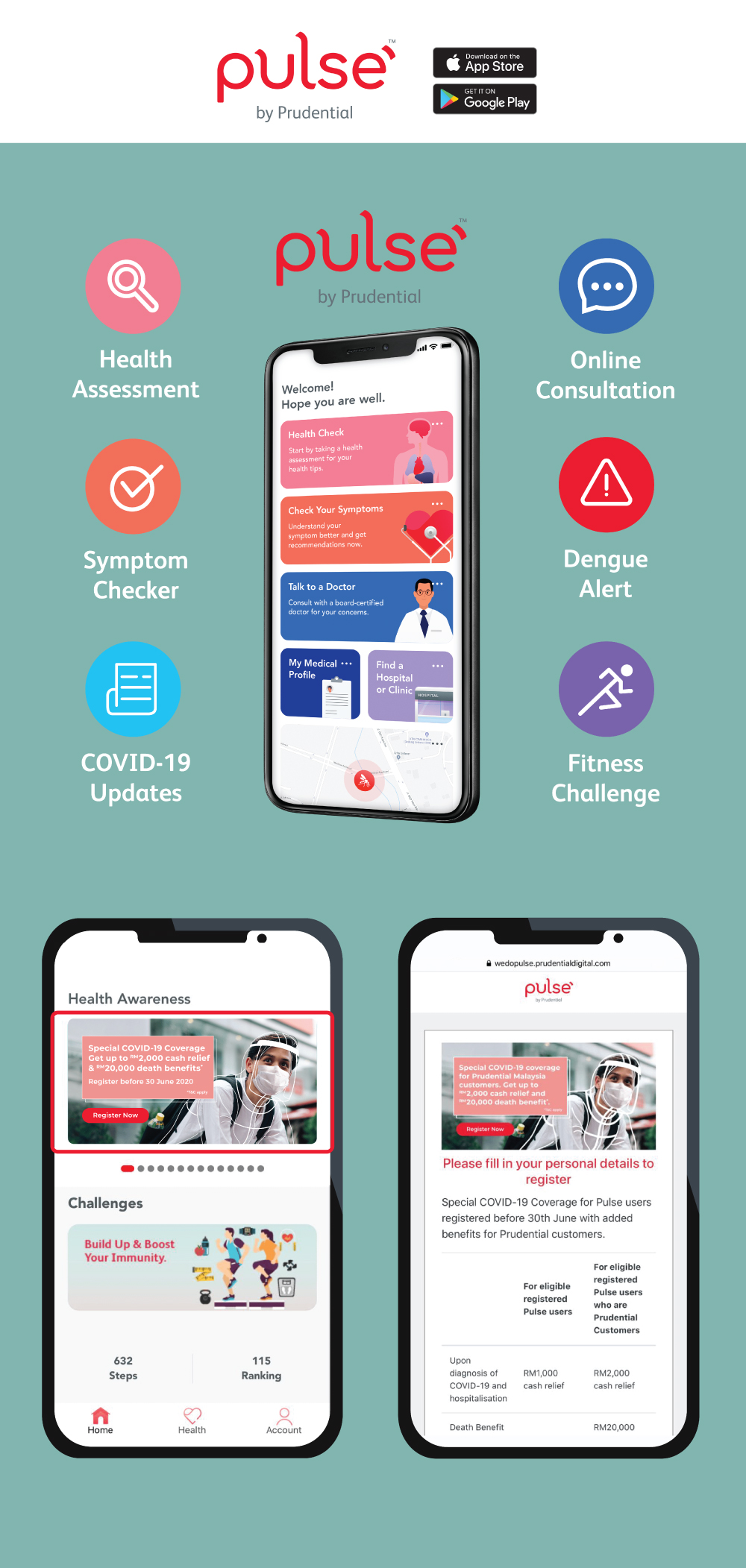

In response to the continuously evolving Covid-19 situation, Prudential Malaysia has enhanced its Special Covid-19 Coverage and will offer individuals a RM1,000 cash relief upon diagnosis and hospitalisation, as well as a RM10,000 death benefit due to Covid-19 from 1 May to 31 December 2020. This amount is doubled for Prudential customers who register for the Special Covid-19 Coverage on Pulse by Prudential (Pulse), i.e. RM2,000 cash relief and RM20,000 death benefit. The Special Covid-19 Coverage is on top of, and does not impact, any existing insurance/takaful coverage.

PAMB CEO Gan Leong Hin highlighted that when Covid-19 was first detected in Malaysia and began to spread, Prudential was the first insurer to waive the exclusion in medical policies and certificates on communicable diseases requiring quarantine by law. It subsequently introduced this Special Covid-19 Coverage.

“In Malaysia, the severity level of Covid-19 has evolved with the emergence of death cases since mid-March. In response to the continuously evolving situation, we have enhanced this coverage so that we can provide the right level of benefits over a broader population and over a longer period of time, to provide peace of mind,” he said at the company's first virtual press conference.

Even non-customers can get free coverage! Prudential has set up a RM300,000 fund specifically to provide free Covid-19 coverage for non-customers. All they need to do is register for the Special Covid-19 Coverage on Pulse. Eligible users will then receive a RM1,000 cash payout as a financial relief upon hospitalisation.

Gan demonstrated how easy it is to sign up on Pulse to get covered, and encouraged all to sign up. When asked why Prudential extended this special coverage for free to non-customers as well, he said “Covid-19 has affected everyone. We understand that there are people who do not have insurance coverage. We want to extend a helping hand to all Malaysians. We believe everyone can do with a little more protection”.

PruBSN CEO Wan Saifulrizal Wan Ismail added, “It is our goal to make healthcare affordable and accessible to everyone. With the Special Covid-19 Coverage and its updated benefits, the lump sum payment can help support one’s financial responsibilities, be it bills, hospitalisation costs, or even daily expenses like food for the family. This virus has changed the way we Malaysians live and Prudential is committed to protecting all Malaysians as we get through this together.”

Pulse by Prudential, launched in August 2019, is a digital health app which is free to download at Google Play and App Store, and free to use. It uses AI-powered self-help tools and real-time information to enable users to get a report on their health status, check on possible causes for their symptoms, and get connected to a doctor for an online/phone consultation.

The app also keeps users updated with the latest health tips and developments on Covid-19. Prudential customers have access to the free online doctor consultation on Pulse, while non-customers can also enjoy the service free of charge upon completion of a health check available on the app.

Besides the Special Covid-19 Coverage, Prudential continues to support the community and public via existing and new collaborations with NGOs and other organisations such as Yayasan Generasi Gemilang (since 2011), Yayasan MyPrihatin, and Islamic Medical Association of Malaysia’s Response and Relief Team (IMARET).

Gan said Covid-19 has changed the way everyone lives and do business, and Prudential has been fortunate in that as an organisation, it has enhanced its digital capabilities several years ago. Hence, it was able to roll out remote facility to support its customers in less than 48 hours after the MCO announcement.

“Covid-19 has emphasised the need for insurance coverage. The awareness for health is much more acute now than ever before. Now, more than ever, we are firmly committed to support and serve our customers and the public at large. That's fundamentally why we exist,” Gan said.

“We will continue to listen to our customers and provide our best to support, protect, and serve them no matter the situation,” Wan Saifulrizal added.

For more information, please visit Prudential Malaysia’s websites :

PAMB - https://www.prudential.com.my/

RM12.50 / month

- Unlimited access to award-winning journalism

- Comment and share your opinions on all our articles

- Gift interesting stories to your friends

- Tax deductable